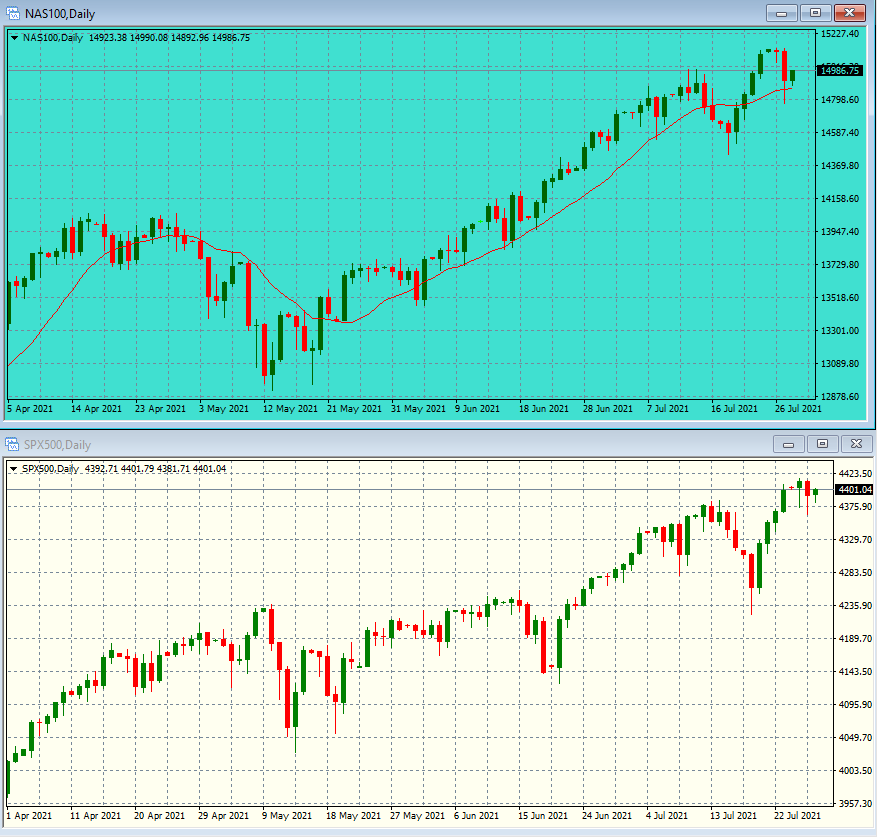

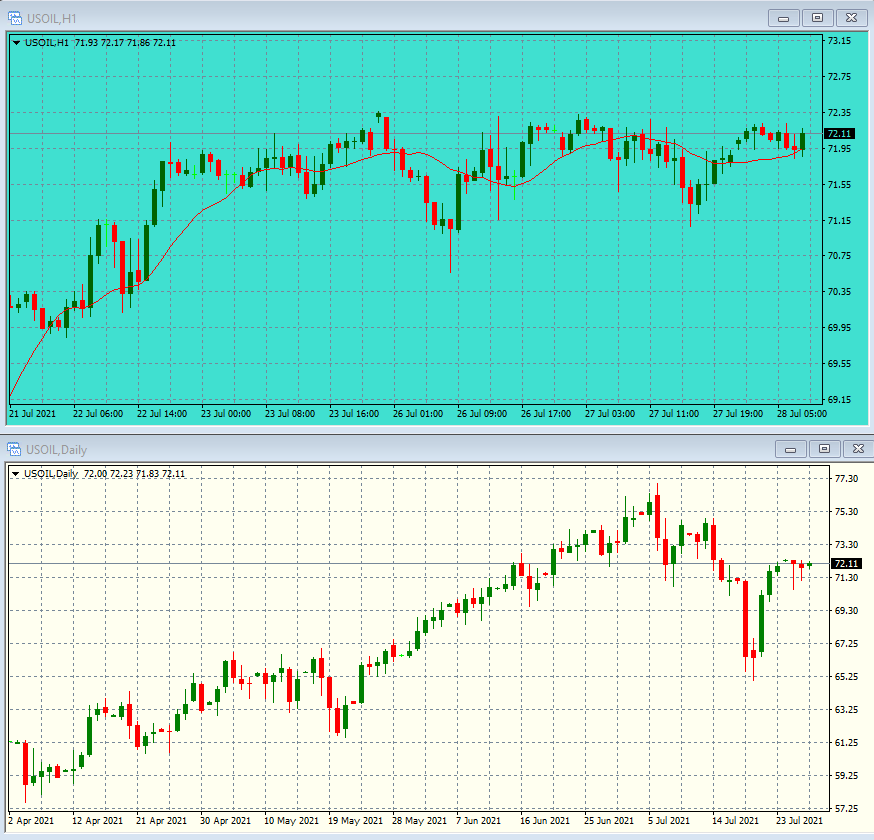

The S&P 500 and Nasdaq 100 futures are trading near the flat line ahead of the FOMC meeting today at 2:00 pm. Asian markets closed mixed their overnight session, the Hang Seng rebounded 1.54% following its worst 3-day selloff in 13 years, and the CSI 300 managed a positive close, up 0.14%. EU markets are trading in positive territory this morning, up 0.51% for the EURSX50 and 0.13% for the DAX index. The dollar is also on guard for the Fed meeting, trading at 92.58 versus majors, up 0.18%, trading below the 6-month highs level. Gold and Silver are trading in different directions this morning, Gold is lower by 0.1% and trading at $1,799 per ounce and Silver is trading higher by 0.7% at $24.65 per ounce. Oil will be in focus today with the release of the Inventories numbers at 10:30 am and is trading higher this morning in expectations of another drawdown in US inventories despite the coronavirus surge. Data from API expects a 4.7 million barrels fall in crude inventories for the week versus the 2.9 million previously expected. Oil is trading higher, at $72.41 per barrel, up 0.98%, ahead of the inventories news release.

US OIL Inventories at 10:30 am and the FOMC meeting and Press Conference at 2:00 pm are the important news on the agenda Wednesday, (all times EST).

| Global Markets 24 hours wrap-up | ||||||

|---|---|---|---|---|---|---|

| Market | GBPUSD | USDJPY | EURJPY | EURUSD | GOLD | OIL |

| 28.7.21 | 0.61% | -0.11% | 0.17% | 0.26% | 0.02% | 1.01% |

| EURGBP | USDCHF | AUDUSD | AUDJPY | USDCAD | Silver | BITCOIN |

| -0.33% | -0.26% | -0.08% | -0.17% | -0.08% | 0.88% | 7.88% |

| Dollar Index | DAX | FTSE100 | CAC40 | EURSXX50 | NIKKEI225 | CSI300 |

| 0.12% | 0.15% | 0.15% | 0.64% | 0.57% | -1.39% | 0.19% |

| 1 YEAR | 14.25% | 14.25% | 33.08% | 23.5% | 21.73% | 4.21% |

| Swing report | ||||||

|---|---|---|---|---|---|---|

| TRADE | ENTRY PRICE | POSITION | OPEN PROFIT | DATE TRIGGERED | STOP LOSS | UPDATES |

| GBPUSD | 3879 | 1 | 2002 | 12/7 | 3678 | CLOSED |

| OPEN PROFIT | $2002 | |||||

US investors are awaiting the FED release today at 2:00 pm, after earnings from technology giants failed to impress last night.

OIL trades higher this morning in expectations of another drawdown in US OIL inventories, set to be released today at 10:00 am.

Warning: The information provided on this page (“the information”) is for instructional purposes only, for enhancing your general knowledge of the capital market in general and using trading methods and the technical analysis method in particular. We hereby clarify that the company, its management, staff, shareholders and agents do not hold investment advisor licenses and/or portfolio manager licenses by any applicable law, and do not pretend to advise any person on the worthiness of buying, selling, holding or investing in securities and other financial assets. The information should not be construed to be a recommendation or opinion, and any person who makes any decision based on the information – does so entirely at their own risk. Be aware that the information cannot serve in lieu of advice which accounts for specific information and needs of an individual, and that investing in securities and financial assets may cause loss. The company, its management, staff and agents may have a personal interest in issues related to the information, and may hold specific securities mentioned in the information, or similar securities. If you use the information, you waive any claim or demand against the company or anyone acting on its behalf.