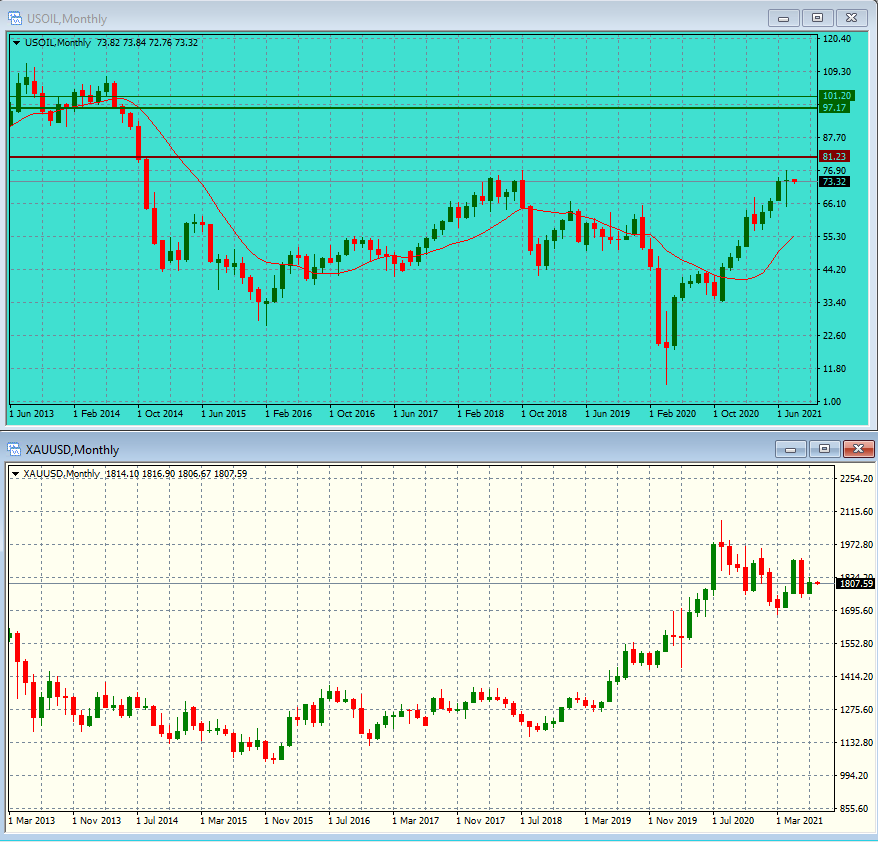

The S&P 500 and Nasdaq 100 futures set to open August higher by 0.55% and 0.6% respectively, extending the US markets monthly run to 14:2 since the coronavirus reversal of April 2020. EU markets are trading higher this morning and Asian markets closed their overnight session green, up 1.82% for the NIKKEI and 2.52% for the battered CSI 300. The Hang-Seng closed July with a stunning 8% loss and gained 0.82% overnight. The dollar is trading near the flat line this morning, at 92.06 versus majors, down 0.12% and down nearly 1% from July highs. Gold and Silver are trading near the flat line as well, Gold is trading at $1,808 per ounce, down 0.34% and Silver is trading at $25.32 per ounce, down 0.05%. Oil prices are trading lower this morning on concerns China economy and factory activity is slowing and OPEC+ is going to ramp production near term. Oil is trading at $73.11 per barrel, down 1.05%.

US ISM manufacturing at 10:00 am is the important news on the agenda Monday, (all times EST).

| Global Markets 24 hours wrap-up | ||||||

|---|---|---|---|---|---|---|

| Market | GBPUSD | USDJPY | EURJPY | EURUSD | GOLD | OIL |

| 2.8.21 | 0.21% | 0.1% | 0.24% | 0.22% | -0.35% | -1.1% |

| EURGBP | USDCHF | AUDUSD | AUDJPY | USDCAD | Silver | Bitcoin |

| 0.17% | 0.06% | 0.41% | 0.27% | -0.08% | -0.05% | -3.9% |

| Dollar Index | DAX | FTSE100 | CAC40 | EURSXX50 | NIKKEI225 | CSI300 |

| -0.12% | 0.83% | 0.88% | 1.76% | 1.01% | 1.82% | 2.55% |

| 1 YEAR | 27.3% | 20.28% | 39.39% | 30.13% | 27.96% | 5.08% |

| Swing report | ||||||

|---|---|---|---|---|---|---|

| TRADE | ENTRY PRICE | POSITION | OPEN PROFIT | DATE TRIGGERED | STOP LOSS | UPDATES |

| OPEN PROFIT | $ | |||||

US leading indexes are now a stunning 14:2, the ratio of green to red trading months since the covid reversal 16-month ago.

Despite a positive July, Gold prices continue to lagg global leading markets, trading is a range for the past 8-months.

Warning: The information provided on this page (“the information”) is for instructional purposes only, for enhancing your general knowledge of the capital market in general and using trading methods and the technical analysis method in particular. We hereby clarify that the company, its management, staff, shareholders and agents do not hold investment advisor licenses and/or portfolio manager licenses by any applicable law, and do not pretend to advise any person on the worthiness of buying, selling, holding or investing in securities and other financial assets. The information should not be construed to be a recommendation or opinion, and any person who makes any decision based on the information – does so entirely at their own risk. Be aware that the information cannot serve in lieu of advice which accounts for specific information and needs of an individual, and that investing in securities and financial assets may cause loss. The company, its management, staff and agents may have a personal interest in issues related to the information, and may hold specific securities mentioned in the information, or similar securities. If you use the information, you waive any claim or demand against the company or anyone acting on its behalf.